Explain the Difference Between Tax Avoidance and Tax Evasion

Tax evasion The failure to pay or a deliberate underpayment of taxes. Example of this is when High earners can significantly reduce their Income Tax by being paid through a private company rather than.

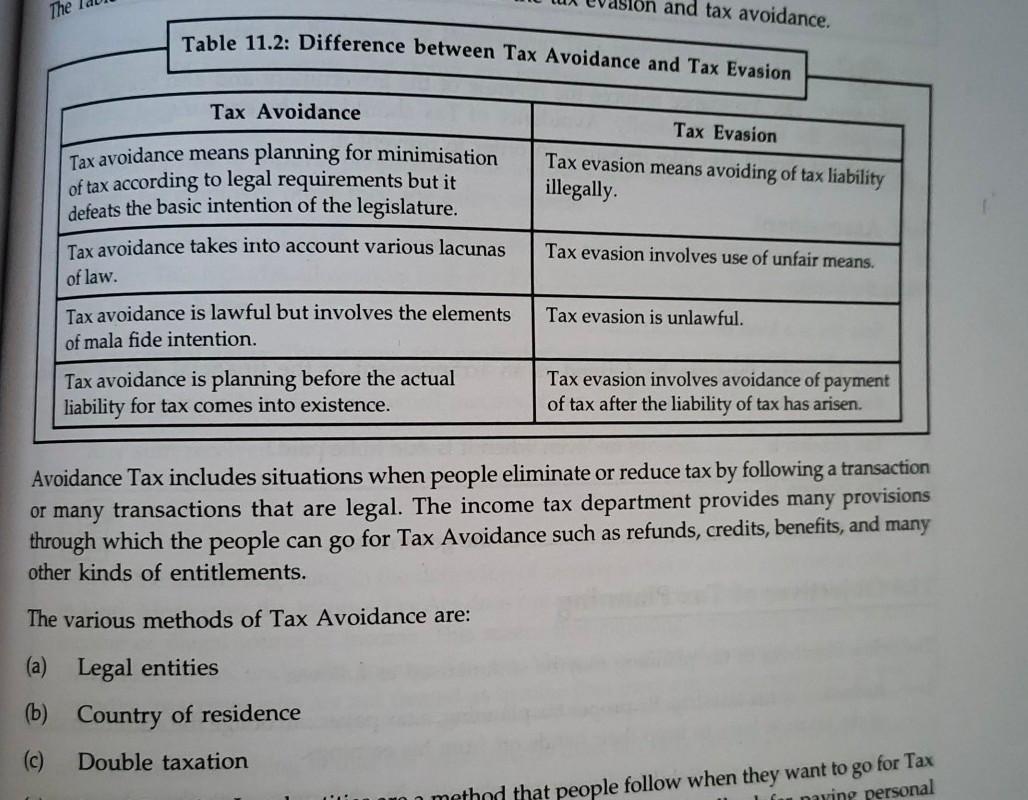

Difference Between Tax Avoidance And Tax Evasion

The terms Tax Evasion and Tax Avoidance are frequently used interchangeably.

. Explain the difference between tax evasion tax avoidance and abusive tax avoidance. Unlike tax avoidance tax evasion has criminal consequences and the individual may face prosecution in criminal court. 1 Excluded topics Specific anti-avoidance legislation Assuranceinsurance tax legislation The procedures relating to enquiries appealsobjections.

Tax avoidance uses the loopholesweakness in tax statutes to reduce or avoid tax liability but tax evasion is the intentional use of fraudulently practices to pay less tax or not to pay tax at all. If you picture tax fraud as a giant umbrella covering the many different forms it takes tax evasion will be one of those crimes underneath the umbrella. The misrepresentation of income can take many forms.

Tax avoidance and tax evasion are both mechanisms used in order to avoid or reduce the amount paid as taxes. Tax evasion is considered a crime. Tax avoidance means legally reducing your taxable income.

Explain the difference between tax. In legal terms there is a big difference between tax avoidance and tax evasion. As considered as fraud tax evasion is an illegal method to reduce tax.

But its not quite as simple as that. A planning made to reduce the tax burden without infringement of the legislature is known as Tax Avoidance. Tax avoidance is performed by availing loopholes in the law but complying with law provisions.

Key Differences The primary key difference tax planning is within the four pillars of the law and if a person is saving the tax by. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Both tax planning and tax avoidance are legal.

Tax evasion means concealing income or information from tax authorities and its illegal. Some of the examples of the Tax Evasion. Deliberate Omission or under-reporting of Tax Liability.

1 e Explain the need for an ethical and professional approach. 2 d Explain the difference between tax avoidance and tax evasion. Tax planning is moral.

The basic difference is that avoidance is legal and evasion is not. Tax evasion occurs when an individual intentionally understates their revenue or overstates their expenses to reduce their tax payable. The core differences which can be determined from these two methods of cutting taxes are as.

Not declaring income to the taxman. While assessee can get punishment which may not be bailable for tax evasion Tax Evasion Tax Evasion is an illegal act. 2 List the information and records that taxpayers need to retain for tax purposes.

With tax evasion the taxpayer intentionally and deliberately misrepresents their taxable income to avoid paying higher taxes to the government. Tax evasion is considered a crime. Unlike tax avoidance tax evasion has criminal consequences and the individual may face prosecution in criminal court.

Explain the differences between tax avoidance and tax evasion. Tax avoidance is immoral. There are many legitimate ways in.

The main difference between tax evasion and tax avoidance lies in that tax evasion is illegal whereas tax avoidance is a legal method used to reduce tax payments that at times can be unethical in nature. Compute the amount of salaries tax payable excluding provisional tax and tax reduction by the taxpayer with the following data if. These both methods fulfil a similar purpose which is to reduce the tax liabilities.

Businesses and sole traders can avoid tax by claiming expenses to reduce their tax bill. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. Essentially the difference between avoidance and evasion is legality.

It often involves artificial transactions that are contrived to. Tax avoidance is legally exploiting the tax system to reduce current or future tax liabilities by means not intended by parliament. Tax evasion is taking illegal steps to avoid paying tax eg.

If youve gone a step further and are deemed to be engaging in aggressive tax avoidance that HMRC doesnt agree with you could be investigated and potentially pay the tax back but it is a murky area at times. Citing suitable examples explain the difference between tax evasion and tax avoidance 4 Marks Tax avoidance is structuring your affairs so that you pay the least amount of tax due. Tax planning and Tax avoidance is legal whereas Tax evasion is illegal.

Tax evasion is lying on your income tax form or any other form. The following are the major differences between Tax Avoidance and Tax Evasion. There is a very thin line difference between tax evasion and tax avoidance thus the taxpayer has to be very diligent and careful while tax planning so that he does not go too far from the legal line of tax avoidance.

By contrast tax evasion means employing illegitimate means for nonpayment of tax. For example Alex works at an accounting firm and wants to minimize his tax bill he claims 700 in. Tax evasion is when you use illegal practices to avoid paying tax.

Underground economy Money-making activities that people dont report to the government. Tax evasion is illegal and objectionable. The major difference between tax avoidance and tax evasion is that tax avoidance is not punishable by law while tax evasion is punishable by law.

Difference between Tax Avoidance and Tax Evasion. Features and differences between Tax evasion Tax avoidance and Tax Planning. For example Alex works at an accounting firm and wants to minimize his tax bill he claims 700 in deductions for fictitious meals and entertainment moreover he neglects to report 7000 he earned in cash from.

Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the lowest rate of tax eg putting savings in the name of your partner to take advantage of their lower tax band.

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

No comments for "Explain the Difference Between Tax Avoidance and Tax Evasion"

Post a Comment